Call us to inquire about investing: (214) 494-8020

Benefits of Investing in Oil and Gas Royalties

Long considered a mailbox investment, royalties are paid first from a well’s pre-expensed production revenue. Royalty owners typically receive 12-25% of cash flow after production taxes have been paid.

Royalty payments are made for as long as an asset produces, which can be upwards of forty years or more in some fields.

Royalty owners are not subject to capital calls or operator assessments; they are not responsible for any costs associated with the drilling of wells nor costs related to production, transportation, marketing, and/or ongoing maintenance of oil and gas properties. In addition, Royalty owners bear no drilling or operating liabilities.

Oil royalties are not affected by increasing interest rates or declining stock prices, which actually tend to drive oil prices higher. This makes oil and gas royalties a hedge against inflation and can be used as a stable, consistent source of income on your investment.

Learn more about this unique opportunity…

Receive Our Free

Investing Prospectus

Get our free prospectus and discover a few things you may not know about Oil & Gas Royalty ownership, including how royalties can play an important part in a well diversified investment portfolio. Accredited Investors Only.

Additional Oil Royalties Investment Benefits

Royalty owners enjoy a depletion allowance which waives income taxes on the first 15% of royalty income on an annual basis.

As like-kind property, oil and gas royalties are eligible for IRC-1031 Exchanges, which provides capital gains tax relief for real estate and energy investors. Click here to learn more.

Royalty owners are not subject to capital calls or operator assessments; they are not responsible for any costs associated with the drilling of wells nor costs related to production, transportation, marketing, and/or ongoing maintenance of oil and gas properties. In addition, Royalty owners bear no drilling or operating liabilities.

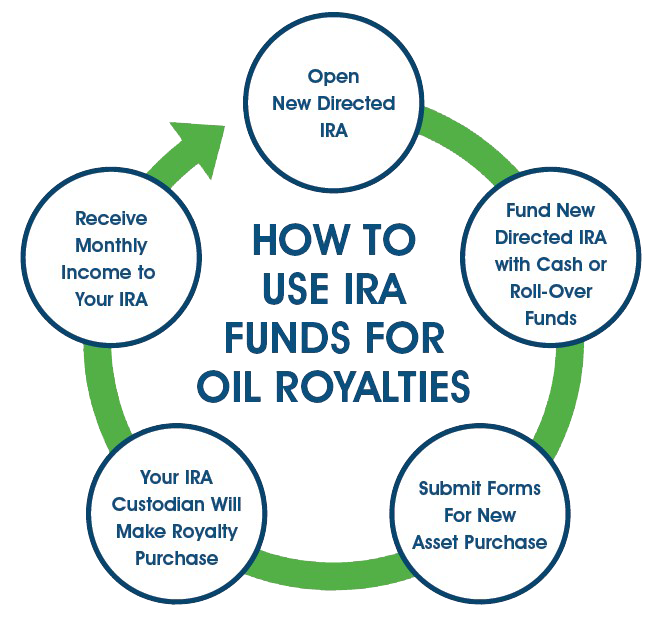

How to Invest in Oil Royalties with Your IRA

- Open a new Directed IRA with a reputable custodian (we can refer you to one).

- Fund your new Directed IRA with available cash or by rolling over funds from an existing retirement account.

- Submit the respective forms from your new IRA custodian for the purchase of an alternative asset.

- Once the account is funded and the alternative asset investment forms are processed, your IRA custodian will make the purchase of a royalty property on your behalf.

- Begin receiving monthly income to your new IRA!

Are royalties a good fit for your portfolio?

Contact Us for a Complementary Consultation

Our experienced team will discuss your current portfolio and help you

determine if investing in royalties makes sense for you.

© Copyright – Guardian Royalties | Privacy Policy | Terms of Service